Table of Content

The VA understands that active military personnel live complicated lives, and because of this there are many exceptions that can be made to the occupancy rules. For example, if you are called to active duty, your spouse may meet the occupancy rule by living at the home full time. The same goes for adult children if both parents are called to active duty.

Another very important part of the VA appraisal is to inspect the home to make sure it meets the VA minimum property requirements . However, the VA appraisal does not take the place of a home inspection, which focuses on code violations, defects and the condition of the property. While you’re waiting for appraisal documents, you’ll be busy submitting documents of your own to your VA-approved lender to show you have the ability to qualify for the loan. If the home passes appraisal for value and VA minimum property requirements, and it’s verified by the lender that you qualify for your loan, the underwriter will give his or her stamp of approval. You will want to find a real estate agent that is well versed in the VA loan process. Because the VA loan have specific guidelines regarding minimum property requirements and occupancy rules, a good agent can help you choose homes that meet these standards.

Mortgage Calculator

Designed to refinance an existing VA mortgage, a streamlined refinance can get you a lower interest rate, reduce the loan term, or go from a variable-rate to a fixed-rate mortgage. We reviewed the following lenders, and while they meet some of our criteria for “top VA loan lenders” , they ultimately didn’t make the cut. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans.

If you used your VA loan entitlement to buy your first home and the loan is still open, you might have remaining entitlement. To qualify for a second VA loan, you’ll need your Certificate of Eligibility from the VA. The number one rule when it comes to VA-acceptable properties is that the home must be your primary residence, not a vacation home. Discover the advantages of the VA loan for military home buyers. Many Veterans & Active Military Members start off their homebuying process wondering the same thing.

VA Loan ⭐️ 2022 Ultimate Military Mortgage Benefits Guide

Programs to benefit first-time buyers or veterans, Rodgers says. A good understanding of the VA loan process will help you get the most from your budget and this incredibly powerful benefit. Talk with a Veterans United loan specialist to kickstart your homebuying journey.

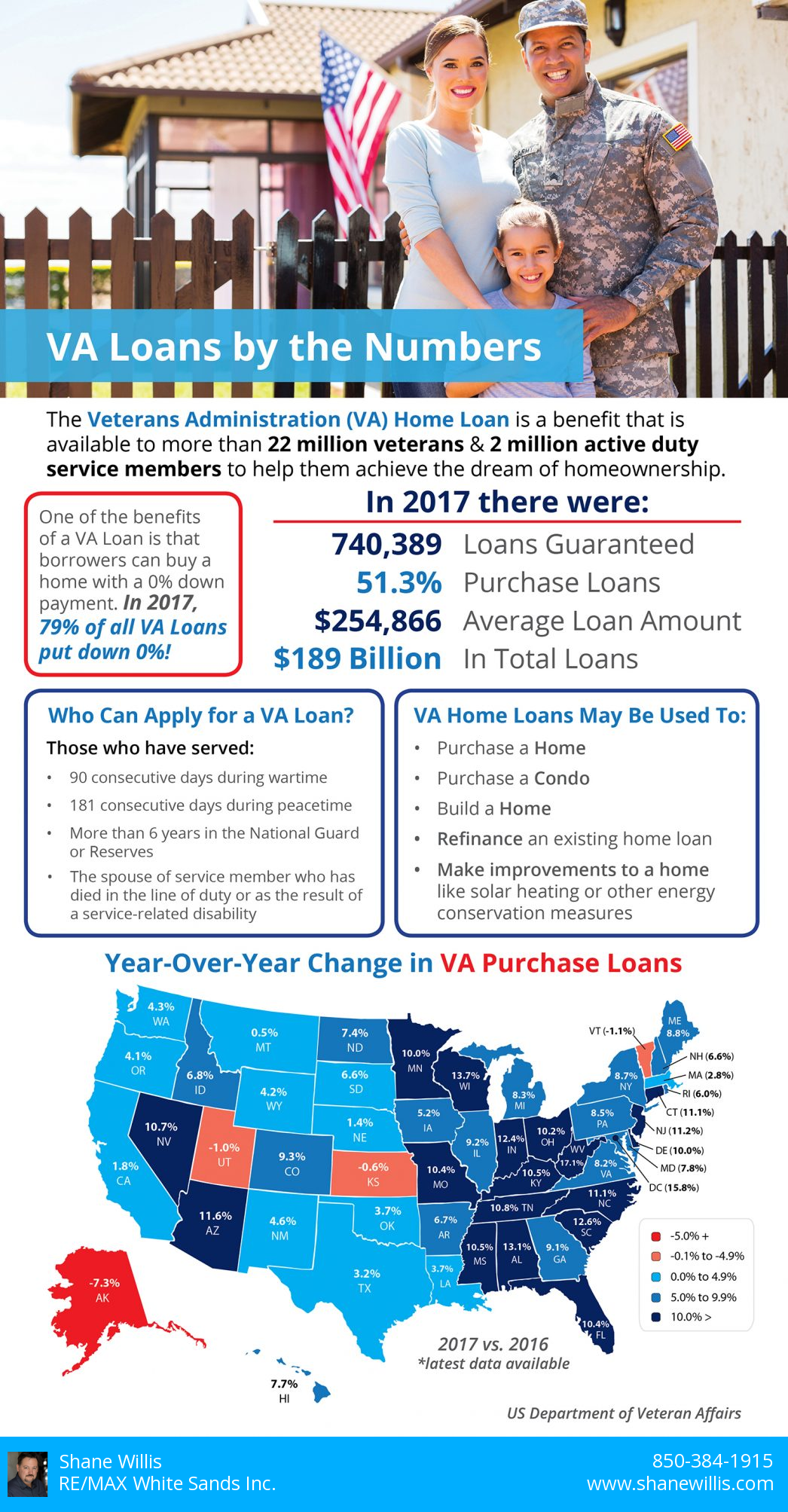

VA loans are backed by the Department of Veterans Affairs and offer exclusive mortgage benefits to eligible servicemembers, veterans and their spouses. A certificate of eligibility is required and can be obtained from the VA by your home loan advisor. Maximum loan amounts are determined by the property location.

Find The Right Home Loan For You

It’d also be wise to speak with homeowners who have lived in their homes for at least a year and ask them how their property has held up. Many homes may look great the day you move in, but months down the road begin showing issues. The last thing you want to deal with is costly home repairs a few months after closing.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

If you are a United States veteran or the surviving spouse of a veteran, you may be qualified for a VA home loan. Because VA loans are backed by the government, they offer more affordable terms with less stringent requirements. Because VA loans are backed by the U.S. government, they can be assumed by a new lender even if they are not active military or veterans. In order to assume a VA loan, the new borrower must have a minimum credit score of 580, a DTI of 45% or lower, pay the VA funding fee and ensure the home will be their primary residence.

You can use your VA loan benefit for a variety of property types. Here we will get into how to purchase a newly built home with a VA loan, and how to get the best deal. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms.

So if you get a VA loan, does that mean all your entitlement is gone? In some situations, you can own two homes at once with a second VA loan, if you have enough remaining entitlement. Before we dive in, let’s take a couple steps back and explain the loan and VA entitlement in more detail.

Your spouse is also able to stand in as an occupant if you’re on active duty. Find a real estate agent who understands VA loans; better still if this person specializes in helping members of the military. Veteran-friendly agents can help you understand what to look for in terms of maximizing your benefits. Next, applicants must demonstrate that they have sufficient income and an acceptable debt-to-income ratio . If so, learn about VA loan requirements to see if you qualify.

If you are just starting to think about a loan, or are ready to start your loan now, Veterans First's specialized lending team is ready to help you without obligation. Fill out our quick online form to see if you prequalify for a VA loan. If you're a veteran, this type of mortgage can eliminate your down payment and help you save you in interest. Lifetime benefit—whether this is your first home or the home you hope to retire in, you can apply for a VA loan even if you have taken out a VA loan in the past. Anglim says their sellers needed to wait to collect equity from the home sale before they could buy a new place and move. They couldn’t find any buyers willing to wait – until Anglim came along.

VA loan terms, rates, monthly payments, and closing costs vary significantly from provider to provider, so having multiple quotes can help you choose the one that hits all your financial goals. NASB’s mortgage rate calculator allows customers to calculate scenarios with credit scores as low as 600 — lower than what other lenders allow for VA loans. Most importantly, NASB charges no origination fees on their VA loans, which can translate into significant savings for borrowers. Qualifying borrowers can take out a VA loan for their primary residence with no- to low-down-payment loans. There are also more lax income and credit requirements, helping veterans become homeowners.

Not having a PMI payment can save you hundreds of dollars every month, allowing you to redirect that money into savings, or enjoy some extra buying power. You (and co-borrower, if applicable) will then attend the loan closing and sign the related papers. The closing escrow agent or attorney will explain loan terms and requirements and monthly payment details. The VA wants to verify that homes are safe, secure and sanitary before backing them. Many crucial structures should be completed when homes are nearing completion. Because VA loans are intended for the purchase of primary residences, you cannot buy a property for the express purpose of having it be a rental property.

Calculating the maximum amount guaranteed by the VA can be complicated because it’s based not only on the amount that has been used previously, but also local conforming loan limits. However, it’s also important because it affects any potential down payment you might have. When a client has partial entitlement left, the VA guarantees the lower of 25% of the loan amount or 25% of the county loan limits minus the client’s used entitlement. As with subsequent refinancing, subsequent mortgage loans carry higher funding fees, although those fees can be reduced with a higher down payment. Similarly, there’s technically no minimum credit score required for getting a VA loan, but again, lenders will review an applicant’s complete credit profile according to their own criteria. In general, most will expect to see a credit score of 620 or higher.

No comments:

Post a Comment